Global Market Performance for 6506497133, 22123524, 603115017, 621693248, 570010686, 947651085

The global market performance of identifiers 6506497133, 22123524, 603115017, 621693248, 570010686, and 947651085 has displayed notable fluctuations amid persistent economic uncertainties. Each identifier’s market dynamics are shaped by various performance metrics, including price-to-earnings ratios and dividend yields. Understanding these trends is essential for investors seeking opportunities. As these assets evolve, the implications for investment strategies become increasingly complex, prompting a closer examination of future prospects.

Overview of Market Trends

As global economies navigate a landscape marked by uncertainty, market trends reflect a complex interplay of factors influencing investor sentiment and economic projections.

Market fluctuations often correlate with key economic indicators, such as inflation rates and employment data.

Understanding these trends is essential for investors seeking to make informed decisions, as they reveal underlying economic health and potential opportunities within increasingly volatile markets.

Performance Metrics for Key Identifiers

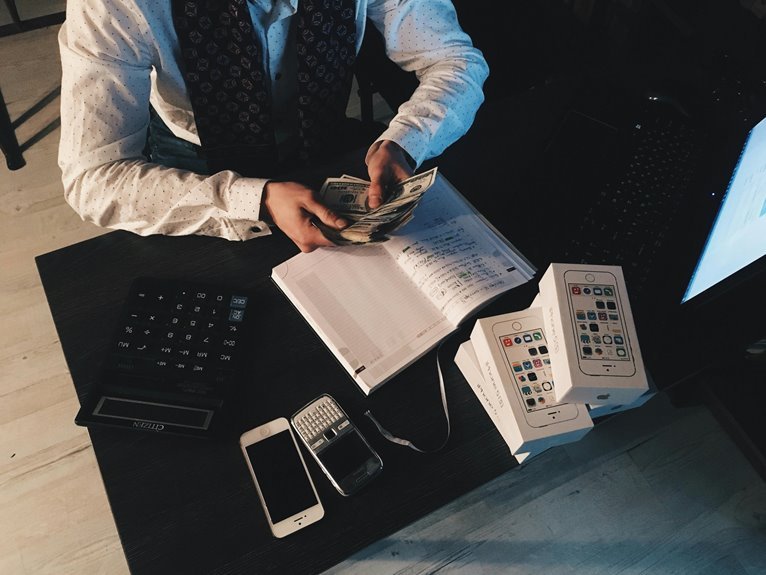

While various performance metrics serve as critical indicators of market health, key identifiers such as price-to-earnings ratios, dividend yields, and market capitalization provide investors with essential insights into asset valuation and potential growth.

These performance indicators are foundational in assessing key metrics, allowing stakeholders to gauge market trends and identify investment opportunities, thereby enhancing informed decision-making in dynamic financial landscapes.

Implications for Investors

Understanding the implications of market performance metrics is crucial for investors aiming to navigate the complexities of the financial landscape.

Investors must refine their investment strategies based on these metrics to optimize returns. Additionally, thorough risk assessment is essential, enabling investors to identify potential vulnerabilities and adjust their portfolios accordingly.

This ensures resilience against market fluctuations and enhances long-term financial freedom.

Future Outlook and Predictions

Although numerous factors influence market dynamics, the future outlook for global markets appears to hinge on key economic indicators and geopolitical developments.

Analysts suggest that while future growth is possible, significant market volatility may persist due to fluctuating interest rates and inflationary pressures.

Investors should remain vigilant, adapting strategies to navigate these uncertainties while seizing potential opportunities for long-term gain.

Conclusion

In summary, the global market performance of identifiers 6506497133, 22123524, 603115017, 621693248, 570010686, and 947651085 underscores the necessity for investors to adopt a nimble approach akin to navigating a digital stock exchange in a dial-up era. As market volatility persists, understanding performance metrics and adjusting strategies accordingly will be vital. Investors who remain proactive and informed are better positioned to capitalize on emerging opportunities while managing inherent risks in this unpredictable landscape.